Banking on Cloud

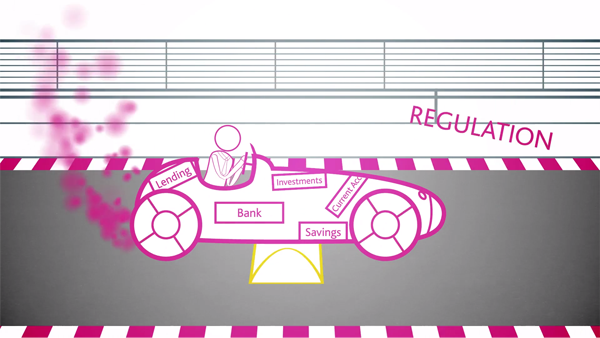

Using the cloud has become essential for meeting the needs of customers in financial services. New market entrants use it to move fast and innovate; while established players understand that the cloud is essential to meet the innovation challenge and increase efficiency. But complex regulatory barriers can cause frictions and hold back adoption. Pinsent Masons and industry body the BBA have boiled those problems down into seven hurdles banks have to clear.

How can banks adopt public cloud solutions with confidence and avoid exposure to regulatory and compliance risk?

Outside the banking industry, public cloud computing drives innovation and enables new competitors, products and more flexible business models. From blockchain to artificial intelligence, there is huge potential for the banking and wider financial services industry to use this technology to help new groups of customers access finance, develop new investment tools, and understand the value of the financial data they hold.

Pinsent Masons and the BBA (now UK Finance) have created a Cloud Computing Working Group for BBA members, to help identify and solve these challenges.

Banking on Cloud

A discussion paper by Pinsent Masons and the BBA (now UK Finance)

In our new Banking on Cloud report, we identify seven hurdles to cloud adoption, including:

- Difficulty in understanding whether use of a specific public cloud technology enables a 'critical' or 'important' operational function of a bank;

- Uncertainty as to what amounts to effective supervision and oversight of a public cloud provider, and its supply chain;

- Issues concerning the location of data including transferring data outside the European Economic Area (EEA) and access to data by law enforcement authorities;

- Issues concerning the management of data including security, data breach reporting and ensuring that new obligations soon to come into effect such as privacy by design and default can be effectively met.